Public Companies Adopting AI Reporting in Changing Markets

Published by Adaptive IR

TL;DR

AI-driven reporting gives public companies a competitive edge, cutting down on time and costs in data analysis.

Discover how insights from proprietary data can enhance decision-making, improve stakeholder engagement, and

adapt to volatile market changes. New tech is helping companies to identify negative pressure on share price and

reduce cost of capital by implementing strategies informed by AI-informed, data-driven analysis.

Why AI-Informed Reporting?

Public companies today face rapid shifts in market trends, regulations, and competitive pressures. Traditional reporting methods are often cumbersome, demanding extensive data gathering and analysis that drains valuable time and resources. AI-driven reporting solutions are changing the game, allowing companies to leverage proprietary data for insights that were previously too costly or time-consuming to access. Imagine compiling trading data in seconds, not hours—empowering data-driven decisions and boosting strategic agility.

Unlock Proprietary Data InsightsProprietary data offers unique insights into market trends, trading patterns, and competitive moves that aren’t always visible through standard data feeds. AI-powered platforms, such as Adaptive IR, integrate comprehensive trading data to help companies identify patterns and respond to market shifts without costly third-party data. Leveraging proprietary information, AI reveals deep insights and visualizes crucial market changes, like price fluctuations, volume trends, and alternative trading systems, giving executives and IR teams fast, actionable insights. With data on trading volume and broker activity, AI-driven reporting supports stronger buy-side engagement and strengthens banking relationships.

Efficiency and AutomationAI’s automation capabilities are transforming reporting by turning time-consuming processes into quick, efficient updates. By reducing manual tasks, companies see faster workflows and fewer errors. AI-generated summaries deliver clear insights on market activity, trading patterns, and price shifts, keeping teams agile and responsive to emerging trends. Data visualization tools simplify complex information, making it easy for executives to make proactive decisions without extensive manual analysis. By saving each IR professional up to a week per year, AI-driven insights boost productivity—and for firms with numerous clients or holdings, they can save hundreds of hours annually.

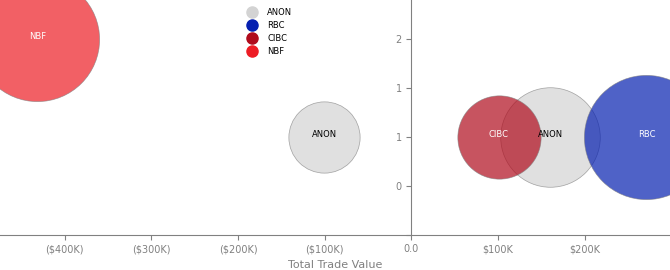

Engage Stakeholders with Visual ReportingKeeping stakeholders informed is critical, and AI-powered reports create intuitive charts and visuals that make complex data accessible. Executives can now communicate key trends and trading patterns in an engaging format that surpasses traditional spreadsheets. For example, an AI-generated chart might highlight volatility versus price against competitors or track broker buying and selling. These visuals make data easily digestible, allowing stakeholders to quickly focus on strategy adjustments that align with market conditions.

Figure 1: Sample of block trading activity chart

Source: Adaptive IR reporting

Cost-Effective, Streamlined Reporting

Beyond improved insights, AI-driven reporting also reduces costs and streamlines reporting. Automating most of the report-building process allows companies to avoid the time and expense of manual reporting, while AI continuously updates critical insights. This efficiency is invaluable for companies requiring frequent updates and offers a cost-effective alternative to traditional data subscriptions, which can exceed C$15,000 to $30,000 per year. With AI handling data aggregation and visualization, teams get fast, affordable reporting and can focus on strategy instead of labor-intensive analysis.

Proactive Risk ManagementEffective risk management is essential in today’s volatile markets, and AI-driven reports help companies identify potential challenges early. AI continuously analyzes data for risk factors, such as shifts in trading activity or economic indicators, and AI-powered “what-if” scenarios allow companies to see how regulatory changes or competitor moves could impact performance. This gives them a chance to adjust strategies proactively and manage risks more effectively.

Agility with Cloud-Based ReportingIn an era of rapid change, cloud-based reporting provides public companies with a flexible, cost-effective way to access high-quality insights without overwhelming costs. By combining proprietary data with automated reporting, capital markets professionals gain an agile solution that adapts to evolving markets and fosters better, more informed decision-making.

Contact Adaptive IR NowWant to learn how Adaptive IR’s reporting products can help your company stay ahead?

Contact [email protected] for more information.